Date: 11-May-2013

Background

DOW reached 15,118 and S&P 500 reached 1,634 on Friday (10-May-2013). Both are close to their historical high. It is time to take a break and think about investment as general for ten, twenty or maybe thirty years ahead to see what would happen.

Aging Population Causes Stock Market Burst?

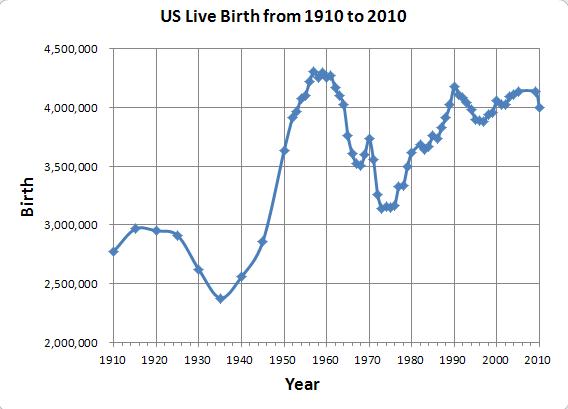

An often cited potential danger to stock market is baby boomers reaching retirement age. They would reduce consumption and drive companies profitability lower and hence lower stock market value. This seems very possible. A chart base on live birth data (source: Vital Statistics of the United States from CDC) from 1910 to 2010 shows that live birth was at historical low at 1935 with 2.37 million live birth. Live birth jumped to 3.6 million in 1950 which was the start of the baby boom. Live birth stayed around 4.2 million from 1956 to 1962. Live birth dropped below 3.5 million in 1972 with 3.2 million live birth. Live birth went up above 3.5 million in 1980 and stayed above 3.5 million from then on. The chart below depicts this trend.

From the data, maximum live birth difference (effective for next 30 years) was 1.2 million (4.3 million in 1957, 3.1 million in 1973). With US population of 315.8 million, the birth difference was 0.38%. Such a small population difference should not cause a huge swing in stock market valuation. Looking at it from second way, even if all these 1.2 million people stops generating any income when they reaches age 66, their total income change would be $60 billion (assuming each makes $50,000). In a $15,000 billion economy, that only presents less than 0.4% of GDP. This small change should be negligible.

Another theory of aging population affecting stock market has to do with spending habit. Older people spends less on common consumption, such as bigger house, better car, better food and child education etc. That will cause these areas to decline. However, older people will spend more on health care, medicine and leisure. This points to a sector shift. Overall spending maybe more instead of less considering how much medical care costs.

As a conclusion, aging population should not cause stock market burst. But it may cause more resources going into medical care.

Housing Boom or Housing Burst?

Second related issue of aging population is housing market shrink. Theory states that aging generation does not need big houses. They will move into smaller, easy to care homes. That assumption makes senses. If one follows this assumption, one would concludes that aging generation would sell their McMansions and move into high rise condos, town houses, or single level houses near population centers for easy access to medical care.

One seventy years old couple would need a master bed room, a guest room and maybe an office/second guest room. The perfect home would be a three bed room unit. Some aging families would prefer high rise condo in city for easy access to care and transportation. Mix use development with super market, office complex and restaurants would be perfect for this population. Some other aging families would move into single level three bed room house/townhome for easy housing care. A very small potion of aging generation would move into apartments. High net worth family like apartment for its worry free living. Low and no net worth family may not afford to purchase a condo.

As a conclusion, simple, small to medium size houses with aging friendly features should maintain their values with aging population. It also sits well for the echo boom generation as their start up house.

Inflation or Deflation?

Will next thirty years be inflationary or deflationary? That’s the most critical question for this investment horizon. If future is inflationary, investor should load up low cost debt to purchase real asset, such as real estate, land, commodity and other inflation protection asset. However, if future is deflationary, investor should not incur debt. In stead, he should purchase debt, such as company bonds, mortgage and other fixed payment asset.

Deloitte has a good paper on this subject, The Great Debate: Inflation, Deflation and the Implications for Financial Management, it lays out reasons for both inflation and deflation. Causes of inflation can be central banks printing money, quantitative easing, record government deficits and regulatory drag. Causes for deflation are high level of unemployment, low speed of money (bank, business, people holding cash instead of spending it), increasing labor productivity, and low level of capacity utilization.

The trend points to inflation in the future. Unemployment rate dropped to 7.5% in April 2013 (source: Databases, Tables & Calculators by Subject by United States Department of Labor). Companies are increasing labor hiring. When federal reserve increases interest rate, banks and businesses would hold less cash and invest more. Speed of money (turn over of money) would increase. This time around, Chinese labor would not hold US inflation down due to their low labor cost (Wal-Mart effect). Chinese labor cost is increasing. Only cause can hold inflation down is labor productivity. After six years of fat trimming in corporate America, labor productivity cannot go much higher without more investment. Investment is inflationary.

On the other hand, drivers for inflation are not mitigated in the foreseeable future. With massive national debt and other national obligation, government is tempted to inflate it way out of debt.

Casual observations show that gasoline price increased 100% from 2005 to 2013. Coffee price went up 50% in 2010. Lumber price increased by 30% in 2010. Wheat and soy bean increased by 24% (Source: How to prepare for Future High Tax and High Inflation in United States). Coca-Cola increased its packaged classic coke price secretly around end of 2012. It used to cost $6 for a package of 24 can of 12 Oz coke in Wal-Mart. Now the package is still $6 but with 20 cans. Coke price increased by 16%.

What should a investor do in an inflationary future? Investors should accumulate asset which can keep its value or increase its value. Real estate and well run company stocks are two options come to mind right away. Two options an investor should avoid are holding too much cash and holding too much long term, low interest, fix income instrument, such as 30 year low yield bonds.

Notes

That is my long term investment outlook. Yours maybe different. Comments are welcome.